32+ how to become a mortgage lender

Get an Entry-Level Position as a Mortgage Banker. Get a bachelors degree.

How To Become A Mortgage Broker In 7 Steps Jw Surety Bonds Blog

Web The current average rate on a 30-year fixed mortgage is 707 compared to 692 a week earlier.

. The higher your down payment and credit score the lower your PMI will be. This is usually a minimum educational requirement at many loan companies. Web How to become a mortgage loan officer.

As a Direct Lender your loan never leaves our care from application to approval. Mortgage bankers mostly work for banks credit unions mortgage companies and other institutional lenders. Consider a bachelors degree.

Web Become a loan officer Create your own team Open your own mortgage branch Move up to correspondent lender status Get your own mortgage lender license Start your own fund to raise capital and invest in the secondary market Achieve bank status to be able to accept deposits Let BNTouch Take You To The Top Aidan Paringer Request a Demo. Obtain a mortgage license. Certified Mortgage Brokers are trusted more by potential borrowers.

Check with your states finance department to determine if a license is required for mortgage lenders. Meet the basic requirements. Web How to Become a Private Mortgage Lender William Freedman Topics.

Obtaining a bachelors degree in business or accounting may help you get a background. Past work experience with a bank or lender could help you develop skills and gain experience. Web Register and certify your business Having limitless funds to lend to companies does not automatically make you a lender.

Web A private mortgage is a financial arrangement between a borrower and a private individual lender in which the lender provides financing to the borrower to purchase a home. If you do not know how to use a computer or the Internet take college courses. Advance in Your Mortgage Banker Career.

A mortgage lender of today must. Earn a high school diploma. Web While youre writing make sure to highlight the top qualities that employers are looking for in a mortgage loan officer including.

Apply for a mortgage. Web Independent mortgage lender New American Funding NAF has partnered with hyper-local news platform Patch to become its exclusive mortgage provider the company announced on Tuesday. The size of the loan.

Its highly recommended to graduate with at least an associate degree in a related subject like finance banking or business. A mortgage bank could be a retail or a direct lenderincluding large banks online mortgage lenders like Quicken or credit unions. Conventional loans with less than 20 down require private mortgage insurance PMI to protect lenders if you default.

Register with governing departments and obtain necessary permits. Web Earn a Degree. Earn a higher-level degree.

Web How to Become a Mortgage Lender Step 1. Web Whether you are just starting your search or already own your dream home A Mortgage is the right choice for financing your home. Mortgage loans are used to buy a home or to borrow money against the value of a home you already own.

The NMLS licensing fee for a mortgage broker in most states is 1500. You may pay between 014 and 233 of your loan amount in annual PMI premiums. Reputation and past performance are an important part of that research.

Seven things to look for in a mortgage. Some business schools provide internships that allow you to obtain experience in lending. Make sure your business is above board.

Web A wholesale mortgage lender is an institution that funds mortgages and offers them to third parties such as a bank credit union mortgage broker or independent mortgage company or professional. Web Most mortgage lenders in the US. The ability to decide whether to approve a loan based on an applicants financial information.

Lenders often offer private mortgages to family friends or others with personal relationships and generate investment profits from the interest. Web Commercial Properties. Web Check your state mortgage licensing laws to understand whether or not youll need a mortgage license before becoming a mortgage broker.

Private lenders frequently offer larger loan amounts than. Web A Mortgage Banker is a banking professional who specializes in mortgage products. Web All mortgage loan brokers must be licensed.

Researching a mortgage company thoroughly before joining it as a loan officer is essential. Choose a Specialty in Your Field. To become a mortgage loan officer you need to be at least 18 years old and have a high school diploma or GED.

Web Mortgage insurance. Private lending can be a useful source of funding for companies looking to buy or renovate commercial real estate. They are usually responsible for helping customers find suitable mortgage loan products and guiding them through the mortgage application process.

All Jobs Mortgage Lender Jobs What Is a Mortgage Lender and How to Become One. Take a class in mortgage banking. Once you finish high school or complete a bachelors degree and are ready to start.

Web Career qualifications for a mortgage lender vary but often include a bachelors degree in finance or a related field as well as licensure or certification. Strong interpersonal and marketing skills. Your loan officer is in constant contact with our in house processing and.

Keen attention to detail and good judgment. Web Lets review the steps you should take to become a loan processor. Continued Education for Your Mortgage Banker Career Path.

Research your states licensure requirements. For borrowers who want a shorter mortgage the average rate on a 15-year fixed mortgage is 632. Web A mortgage is an agreement between you and a lender that gives the lender the right to take your property if you fail to repay the money youve borrowed plus interest.

To be approved for an NMLS license you must often complete 20 hours of pre-licensing training through an approved organization. Pass the SAFE MLO. While many mortgage bankers can build their careers with only high school diplomas or.

Aspiring brokers need to complete a pre-licensure program a 20-hour class that will cover relevant federal and state laws and financial regulations. Only one point of contact keeps the process simple for you. Alternative Investments Takeaways Private mortgage lending requires no licensure certification or degree It is a high-risk high-reward business with an established stepwise procedure for setting up and marketing a new entity.

Web How to become a mortgage banker 1. Web How to become a lender 1.

Mike Meena Associates Home Loans Santa Clarita Ca

How To Become A Mortgage Loan Officer Steps Requirements

The Complete Guide To Becoming A Mortgage Broker

The Complete Guide To Becoming A Mortgage Broker

How To Become A Top 10 Producing Mortgage Lender And Stay There

How To Become A Mortgage Broker Mortgage Professional

The Complete Guide To Becoming A Successful Mortgage Broker Insider Secrets You Need To Know Insider Secrets You Need To Know Hughes Patricia 9781601381309 Amazon Com Books

How To Become A Top 10 Producing Mortgage Lender And Stay There

How To Become A Top 10 Producing Mortgage Lender And Stay There

The Complete Guide To Becoming A Successful Mortgage Broker Insider Secrets You Need To Know Insider Secrets You Need To Know Hughes Patricia 9781601381309 Amazon Com Books

How To Start A Mortgage Company 15 Steps With Pictures

The Complete Guide To Becoming A Successful Mortgage Broker Insider Secrets You Need To Know Insider Secrets You Need To Know Hughes Patricia 9781601381309 Amazon Com Books

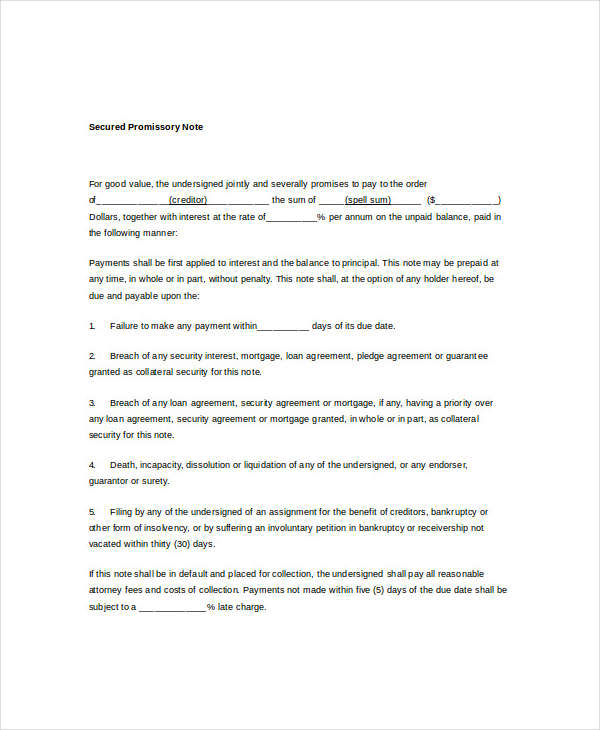

Mortgage Note 6 Examples Format Pdf Examples

How You Can Create A Passive Full Time Income In 90 Days Or Less By

How To Become A Top 10 Producing Mortgage Lender And Stay There

Which Mortgage Is Better 15 Vs 30 Year Home Loan Comparison Calculator

Getting A Mortgage After Bankruptcy And Foreclosure